An Actuary analyses mathematical, statistical, demographic, financial or economic data to predict and assess the long-term risk involved in financial decisions and planning.

Occupation description

An Actuary analyses mathematical, statistical, demographic, financial or economic data to predict and assess the long-term risk involved in financial decisions and planning.

Occupations not considered under this ANZSCO code:

- Mathematician

- Statistician

- Accountants

- Corporate Treasurer

- Economist

- Financial Investment Adviser

- Financial Investment Manager

- Information and Organisation Professionals

- Policy Analyst

- Specialist Managers, including Finance Manager

These occupations are classified elsewhere in ANZSCO or are not at the required skill level.

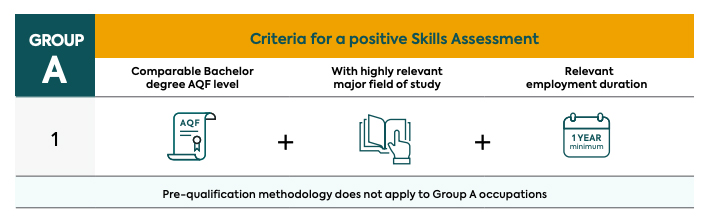

Actuary is a VETASSESS Group A occupation

This occupation requires a qualification assessed as comparable to the educational level of an Australian Qualifications Framework (AQF) Bachelor degree or higher, in a field highly relevant to the nominated occupation.

The information below describes the available pathways for a Skills Assessment under Group A. Please note that in order to achieve a suitable Skills Assessment Outcome, a suitable assessment for both qualifications and employment is required.

Pathway 1

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Bachelor degree or higher degree and in a field highly relevant to the nominated occupation.

Bachelor degree or higher degree includes AQF Master Degree or AQF Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least one year of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Qualification and Employment Criteria

Employment

In instances where an applicant has an underpinning qualification at the required level that is not considered highly relevant in itself, but also possesses a Fellowship or Associateship of a body with which the Actuaries Institute of Australia holds a Mutual Recognition Agreement, the major field of study requirements will be considered as met.

In instances where an applicant has an underpinning qualification at the required level that is not considered highly relevant in itself, but they have undertaken further exams or are working towards completion of qualifications from, or membership or fellowship of, recognised actuarial institutes, a positive qualification outcome may be considered on a case-by-case basis provided all the six core principle subjects are completed.

Applicants are required to provide evidence, such as certificates, transcripts and syllabuses.

Highly relevant tasks include, but are not limited to:

- defining, analysing and solving complex financial and business problems relating to areas such as insurance premiums, annuities, superannuation funds, pensions and dividends.

- examining financial projections for general insurance companies, finance companies, government and other organisations.

- designing new types of policies, assessing risks and analysing investments in life insurance, superannuation funds, health insurance, friendly societies, financial markets and other areas.

Employment Information

Actuaries work in a variety of practice areas such as General Insurance, Life Insurance, Banking, Data Analytics, Risk Management, Health, Wealth Management etc. They are actively involved in the development and modification of complex actuarial models.

Actuaries are expected to employ complex quantitative modelling techniques in the course of their work to analyse opportunities and risks.

Get Support

Help with a Skills Assessment

Skills Assessment Support (SAS) services are for migration agents, legal practitioners and prospective applicants who are yet to submit their Skills Assessment application to VETASSESS.

Help with an urgent application

For general and professional occupations, priority processing can be used to fast-track urgent applications

How to apply

If you're a professional choosing to migrate to Australia, chances are you're likely to be assessed by us. We assess 361 different professional occupations, assessing your skills, experience and qualifications.

Find

Find the VETASSESS occupation that most closely fits your skills and experience.

Match

Match your skills and experience to your chosen occupation.

Prepare

Get ready to apply by preparing all the information and documents you need.

Apply

Apply online when you’re ready. If you’re still unsure, skills assessment support is available when you need it.