An Insurance Broker operates as an independent agent to sell life, fire, accident, industrial or other forms of insurance for a range of insurance companies.

Occupation description

An Insurance Broker operates as an independent agent to sell life, fire, accident, industrial or other forms of insurance for a range of insurance companies.

Occupations not considered under this ANZSCO code:

- Insurance Agent

- Finance Broker

- Financial Brokers nec

- Business Broker

- Financial Investment Advisers and Managers

- Insurance Consultant (Insurance Clerk)

These occupations are classified elsewhere in ANZSCO or are not at the required skill level.

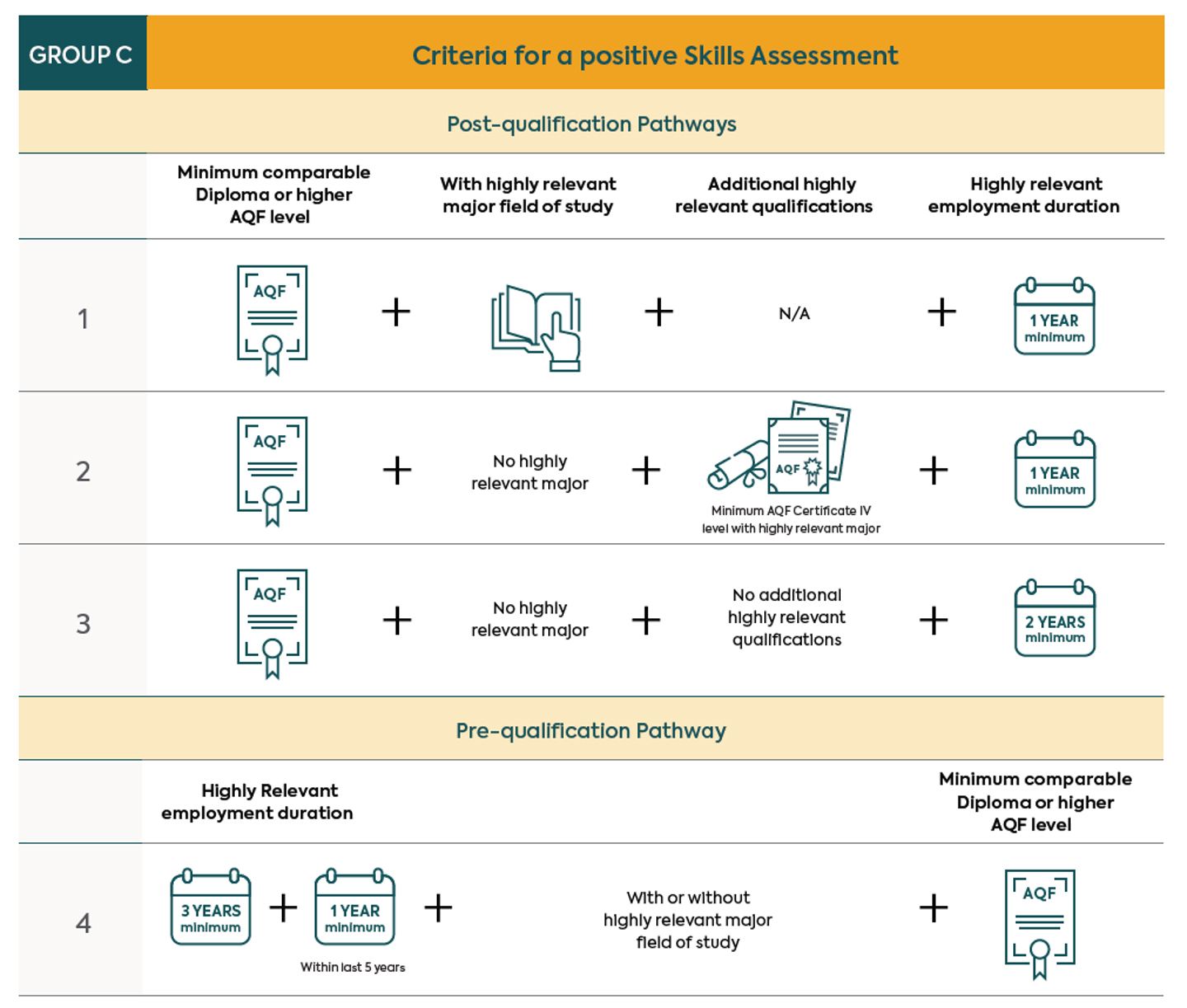

Insurance Broker is a VETASSESS Group C occupation

This occupation requires a qualification assessed as comparable to the educational level of an Australian Qualifications Framework (AQF) Diploma or higher.

Description of Pathways

The information below describes the available pathways for a Skills Assessment under Group C. Please note that in order to achieve a successful Skills Assessment Outcome, a suitable assessment for both qualifications and employment is required.

Pathway 1

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Diploma or higher and in a field highly relevant to the nominated occupation.

Diploma or higher includes AQF Advanced Diploma, Associate Degree, Bachelor Degree, Graduate Diploma, Master Degree or Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least one year of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Pathway 2

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Diploma or higher and in a field not highly relevant to the nominated occupation.

Diploma or higher includes AQF Advanced Diploma, Associate Degree, Bachelor Degree, Graduate Diploma, Master Degree or Doctoral Degree.

An additional qualification in a highly relevant field of study at a minimum AQF Certificate IV level is required. Additional qualifications in a highly relevant field of study include those comparable to the AQF Certificate IV.

In addition, it is essential for applicants to meet the following employment criteria:

- at least one year of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Pathway 3

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Diploma or higher and in a field not highly relevant to the nominated occupation.

Diploma or higher includes AQF Advanced Diploma, Associate Degree, Bachelor Degree, Graduate Diploma, Master Degree or Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least two years of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Pathway 4

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Diploma or higher with or without a highly relevant major field of study to the nominated occupation.

Diploma or higher includes AQF Advanced Diploma, Associate Degree, Bachelor Degree, Graduate Diploma, Master Degree or Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least four years of employment at an appropriate skill level that includes at least one year of highly relevant employment within the last five years before applying,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Qualification and Employment Criteria

Employment

Highly relevant tasks include, but are not limited to:

- Interviewing prospective clients to explain insurance policy conditions, risks covered, premium rates and benefits, and making recommendations on the amount and type of cover required.

- Arranging insurance for clients through banks, lenders, financiers and insurance companies.

- Identifying and advising on significant risk changes to clients’ insurance.

Additional tasks may include:

- Compiling lists of prospective clients from directories and other sources.

- Making contact with prospective clients to seek interviews and gauge interest.

- Researching and reviewing available insurance products to ensure the most appropriate are offered to clients.

- Dealing with clients to facilitate insurance meetings and to grow the existing insurance portfolio.

- Achieving budgeted revenue for retention and growth in business.

Employment information

An Insurance Broker is a professional adviser with knowledge of insurance and risk management. Brokers work on behalf of their clients, not for insurance companies, and are generally required to provide professional advice in their clients’ best interest. They may specialise in one specific type of insurance or industry, or they may deal with many different types. Some Insurance Brokers may be self-employed.

Employment as an Insurance Agent will not be considered as highly relevant, as agents representing a particular company only provide advice on that company’s insurance products. Insurance Brokers operate independently to arrange insurance from a range of companies.

Supporting Material for Assessment

When applying for a Skills Assessment, please ensure you submit sufficient evidence supporting your proof of identity, qualification and employment claims. Applicants nominating this occupation are required to provide evidence in line with VETASSESS documentation requirements (see List of Required Documents).

While the VETASSESS Skills Assessment for migration purposes is distinct from an assessment for licensing or registration purposes, you are advised to provide copies of relevant licences (including from overseas), if held.

You should also provide details of any relevant training or professional development courses undertaken. These may be detailed in the Curriculum Vitae/Resume provided.

Get Support

Help with a Skills Assessment

Skills Assessment Support (SAS) services are for migration agents, legal practitioners and prospective applicants who are yet to submit their Skills Assessment application to VETASSESS.

Help with an urgent application

For general and professional occupations, priority processing can be used to fast-track urgent applications

How to apply

If you're a professional choosing to migrate to Australia, chances are you're likely to be assessed by us. We assess 361 different professional occupations, assessing your skills, experience and qualifications.

Find

Find the VETASSESS occupation that most closely fits your skills and experience.

Match

Match your skills and experience to your chosen occupation.

Prepare

Get ready to apply by preparing all the information and documents you need.

Apply

Apply online when you’re ready. If you’re still unsure, skills assessment support is available when you need it.