An Insurance Loss Adjuster inspects and assesses the damage and loss to insured property and business, estimates insurance costs, and acts to minimise the cost of claims to an insurance company.

Occupation description

An Insurance Loss Adjuster inspects and assesses the damage and loss to insured property and business, estimates insurance costs, and acts to minimise the cost of claims to an insurance company.

Occupations considered suitable under this ANZSCO code:

- Insurance Loss Assessor

Occupations not considered under this ANZSCO code:

- Insurance Investigator

- Insurance Risk Surveyor

- Insurance Agent

- Insurance Broker

- Insurance Consultant (Insurance Clerk)

These occupations are classified elsewhere in ANZSCO or are not at the required skill level.

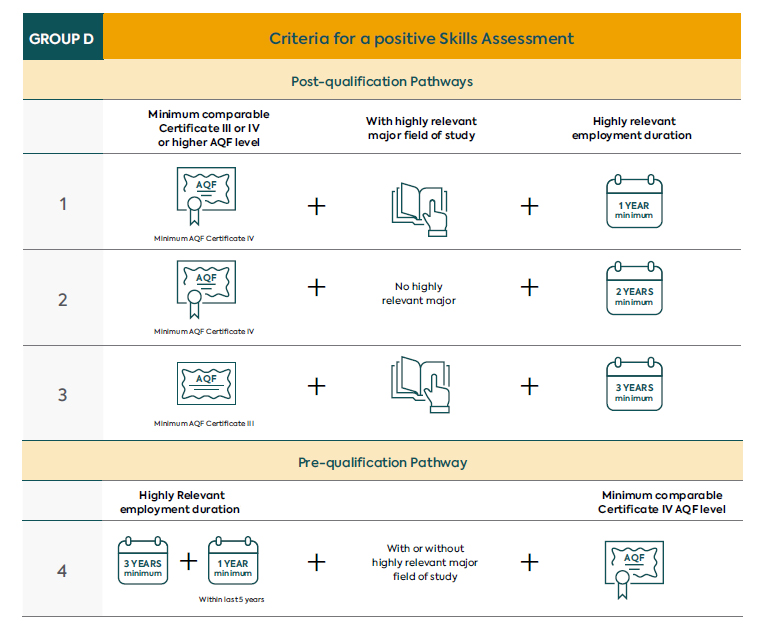

Insurance Loss Adjuster is a VETASSESS Group D occupation

This occupation requires a qualification assessed as comparable to the educational level of an Australian Qualifications Framework (AQF) Certificate III or IV.

Applicants can fulfil the assessment criteria for this occupation in one of four ways.

Description of Pathways

The information below describes the available pathways for a Skills Assessment under Group D. Please note that in order to achieve a successful Skills Assessment Outcome, a suitable assessment for both qualifications and employment is required.

Pathway 1

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Certificate IV or higher and in a field highly relevant to the nominated occupation.

Certificate IV or higher includes AQF Diploma, Advanced Diploma, Associate Degree, Bachelor Degree, Graduate Diploma, Master Degree or Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least one year of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Please note: The qualification level requirement AQF Certificate IV or higher can be satisfied by one qualification, while the requirement for a highly relevant major can be met by a separate qualification at a minimum of AQF Certificate III level.

Pathway 2

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Certificate IV or higher and in a field not highly relevant to the nominated occupation.

Certificate IV or higher includes AQF Diploma, Advanced Diploma, Associate Degree, Bachelor Degree, Graduate Diploma, Master Degree or Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least two year of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Please note - This pathway applies where a qualification is assessed at AQF Certificate IV level or higher and is not highly relevant to the nominated occupation, or where no other relevant qualification at AQF Certificate III level is available for consideration.

Pathway 3

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Certificate III in a field highly relevant to the nominated occupation.

In addition, it is essential for applicants to meet the following employment criteria:

- at least three years of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Pathway 4

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Certificate IV or higher with or without a highly relevant major field of study to the nominated occupation.

Certificate IV or higher includes AQF Diploma, Advanced Diploma, Associate Degree, Bachelor Degree, Graduate Diploma, Master Degree or Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least four years of employment at an appropriate skill level that includes at least one year of highly relevant employment within the last five years before applying,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Qualification and Employment Criteria

Employment

Highly relevant tasks include, but are not limited to:

- Inspecting damaged buildings, equipment and motor vehicles and estimating the cost of repairs.

- Estimating business losses resulting from fire, theft and other business disruptions.

- Reporting the extent of damage and estimated costs to the insurer.

Employment information

Insurance Loss Adjusters investigate insurance claims on behalf of the insurer, establishing whether and to what extent insurance companies are liable. They are generally required to abide by industry codes of conduct, and may come from a variety of backgrounds. They are normally employed by an insurance company or an independent specialist adjusting company.

Supporting material for assessment

When applying for a Skills Assessment, please ensure you submit sufficient evidence supporting your proof of identity, qualification and employment claims. A full list of the documents required can be found on the VETASSESS website under Eligibility Criteria.

While the VETASSESS Skills Assessment for migration purposes is distinct from an assessment for licensing or registration purposes, you are advised to provide copies of relevant licences (including from overseas) if held.

You are also further encouraged to provide evidence of membership of, or affiliation to, industry or professional bodies and copies of any relevant prizes, certificates or other forms of commendation.

You should also provide details of any relevant training or professional development courses undertaken. These may be detailed in the Curriculum Vitae/Resume provided.

Get Support

Help with a Skills Assessment

Skills Assessment Support (SAS) services are for migration agents, legal practitioners and prospective applicants who are yet to submit their Skills Assessment application to VETASSESS.

Help with an urgent application

For general and professional occupations, priority processing can be used to fast-track urgent applications

How to apply

If you're a professional choosing to migrate to Australia, chances are you're likely to be assessed by us. We assess 361 different professional occupations, assessing your skills, experience and qualifications.

Find

Find the VETASSESS occupation that most closely fits your skills and experience.

Match

Match your skills and experience to your chosen occupation.

Prepare

Get ready to apply by preparing all the information and documents you need.

Apply

Apply online when you’re ready. If you’re still unsure, skills assessment support is available when you need it.