Financial Investment Managers invest and manage sums of money and assets on behalf of others over an agreed period of time, in order to generate income and profit. Registration or licensing is required.

Occupation description

Financial Investment Managers invest and manage sums of money and assets on behalf of others over an agreed period of time, in order to generate income and profit. Registration or licensing is required.

Occupations considered suitable under this ANZSCO code:

- Portfolio Manager

- Superannuation Funds Manager

- Unit Trust Manager

Occupations not considered under this ANZSCO code:

- Finance Manager (ANZSCO Code 132211)

- Financial Institution Branch Manager (ANZSCO Code 149914)

- Accountants (ANZSCO Unit Group 2211)

- Corporate Treasurer (ANZSCO Code 221212)

- Financial Investment Adviser (ANZSCO Code 222311)

- Financial Market Dealer (ANZSCO Code 222211)

- Futures Trader (ANZSCO Code 222212)

- Stockbroking Dealer (ANZSCO Code 222213)

- Financial Dealers NEC (ANZSCO Code 222299)

- Financial Brokers NEC (ANZSCO Code 222199)

- Commodities Trader (ANZSCO Code 222111)

- Finance Broker (ANZSCO Code 222112)

- Insurance Broker (ANZSCO Code 222113)

These occupations are classified elsewhere in ANZSCO

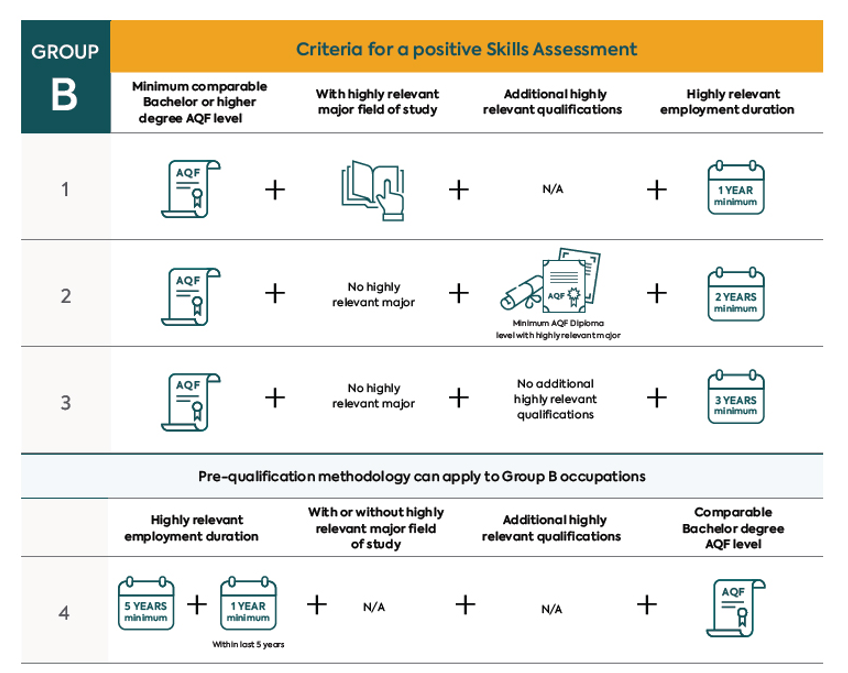

Financial Investment Manager is a VETASSESS Group B occupation

This occupation requires a qualification assessed as comparable to the educational level of an Australian Qualifications Framework (AQF) Bachelor degree or higher.

Description of Pathways

The information below describes the available pathways for a Skills Assessment under Group B. Please note that in order to achieve a successful Skills Assessment Outcome, a positive assessment for both qualifications and employment is required.

Pathway 1

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Bachelor degree or higher degree and in a field highly relevant to the nominated occupation.

Bachelor degree or higher degree includes AQF Master Degree or AQF Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least one year of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Pathway 2

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Bachelor degree or higher degree and in a field not highly relevant to the nominated occupation.

Bachelor degree or higher degree includes AQF Master Degree or AQF Doctoral Degree.

An additional qualification in a highly relevant field of study at a minimum AQF Diploma level is required. Additional qualifications in a highly relevant field of study include those comparable to the AQF Diploma or AQF Advanced Diploma or AQF Associate Degree or AQF Graduate Diploma.

In addition, it is essential for applicants to meet the following employment criteria:

- at least two years of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Pathway 3

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Bachelor degree or higher degree and in a field not highly relevant to the nominated occupation.

Bachelor degree or higher degree includes AQF Master Degree or AQF Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least three years of post-qualification employment at an appropriate skill level, undertaken in the last five years,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Pathway 4

This pathway requires a qualification assessed as comparable to the education level of an Australian Qualifications Framework (AQF) Bachelor degree or higher degree with or without a highly relevant major field of study to the nominated occupation.

Bachelor degree or higher degree includes AQF Master Degree or AQF Doctoral Degree.

In addition, it is essential for applicants to meet the following employment criteria:

- at least six years of employment at an appropriate skill level that includes at least one year of highly relevant employment within the last five years before applying,

- working 20 hours or more per week, and

- highly relevant to the nominated occupation.

Qualification and Employment Criteria

AQF Bachelor degree or higher degree*

This occupation requires a qualification in any of the following areas:

- Finance or Financial Planning

- Economics/Econometrics

- Actuarial Studies

On a case-by-case basis, the following major fields of study may be accepted, when an applicant’s subsequent employment is highly relevant:

- IT

- Mathematics

- Statistics

- Physics

- Engineering

Employment

Highly relevant tasks include:

- Monitoring investment performance, and reviewing and revising investment plans based on modified needs and changes in markets;

- Advising on investment strategies, sources of funds and the distribution of earnings;

- Setting financial objectives, and developing and implementing strategies for achieving the financial objectives;

- Managing funds raised from personal superannuation savings policies and unit trusts;

- Assisting in meeting superannuation compliance requirements;

- Directing the collection of financial, accounting and investment information and the preparation of budgets, reports, forecasts and statutory returns;

- May refer clients to other organisations to obtain services outlined in financial plans.

Additional tasks may include, but are not limited to:

- Managing funds consolidated from various investors;

- Ensuring the profitability of the funds managed;

- Analysing assigned portfolio(s) and formulating strategies to meet long term goals;

- Monitoring markets and staying up-to-date with trends.

Employment information

Financial Investment Managers usually work for fund or superannuation management companies and manage funds from various investors in order to provide a return. Most Financial Investment Managers do not provide financial advice directly to clients. The Financial Investment Manager and/or the companies they are working for should be licensed for the investment activities that they are involved in.

Employment primarily focused on undertaking research and creating periodical reports on financial/ investment trends or background issues is not considered highly relevant. The employment must involve the management of sums of money and assets on behalf of others.

Supporting material for assessment

While the VETASSESS Skills Assessment for migration purposes is distinct from an assessment for licensing or registration purposes, applicants are advised to provide copies of relevant licences (including from overseas) if held. Reference letters from employers should include detail of tasks undertaken and (in general terms) the portfolios/funds managed.

If you are nominating this occupation, you may submit an organisational chart. An organisational chart should include the company letterhead, your job position and those of your superiors and subordinates as well as all positions reporting to your immediate supervisor and to your direct subordinates.

You should also provide details of any relevant training or professional development courses undertaken. These may be detailed in the Curriculum Vitae Resume provided.

Get Support

Help with a Skills Assessment

Skills Assessment Support (SAS) services are for migration agents, legal practitioners and prospective applicants who are yet to submit their Skills Assessment application to VETASSESS.

Help with an urgent application

For general and professional occupations, priority processing can be used to fast-track urgent applications

How to apply

If you're a professional choosing to migrate to Australia, chances are you're likely to be assessed by us. We assess 361 different professional occupations, assessing your skills, experience and qualifications.

Find

Find the VETASSESS occupation that most closely fits your skills and experience.

Match

Match your skills and experience to your chosen occupation.

Prepare

Get ready to apply by preparing all the information and documents you need.

Apply

Apply online when you’re ready. If you’re still unsure, skills assessment support is available when you need it.